Apr 28, 2024

benjamin-sterling

It's been officially over 6 months since the IRS initially announced the ERC moratorium.

If you filed your claim anywhere between the beginning of 2023 and the beginning of 2024, I have some good and bad news for you.

Let's start with the bad news - No one really knows when, but you probably won't receive your ERC payouts anytime soon (at least 3-4 months to over a year).

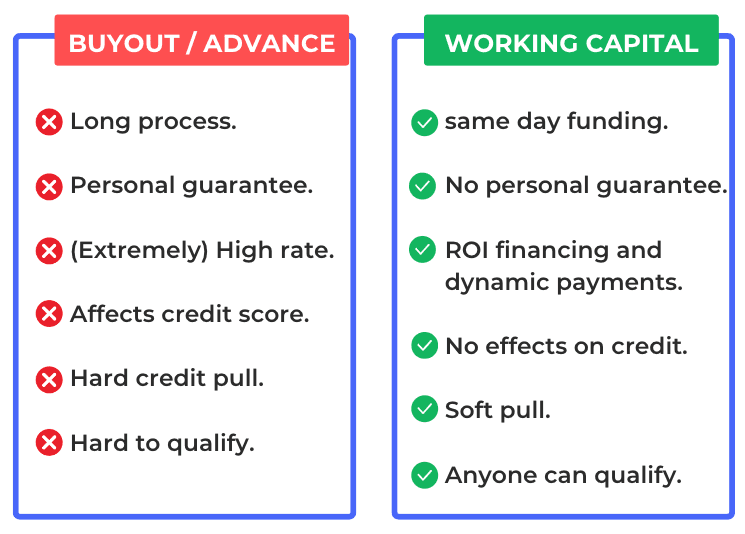

On the other hand, the good news is that you might have just stumbled upon the perfect solution - is that you might have just stumbled upon the perfect solution that will make you forget about your ERC arrival. And no, it's not a 'buyout' or any type of an 'ERC' advance' where lenders ask for 20% of your calculated amount.

If you are an existing client of ours or have come across the services we provide at NYS, you may have noticed that we previously offered an ERC advance and a buyout. However, I have some news for you: not anymore.

We noticed that almost EVERY client that we’ve tried to help with advancing their ERC was actually qualified for a much better solution, and it simply didn't make sense to go after a buyout or an advance.

The solution I'm talking about is not only faster and cheaper, it's also much more flexible with no strings attached compared to a buyout/advance, such as:

• No personal guarantee

• No hard credit pull

• 2-4 Days to complete the whole process

• And most importantly, nowhere near 15% to 25% of your ERC refund

Before I show you exactly what this solution I'm talking about is, one of the things we noticed most about clients who came to us for advancing their ERC is that almost all of them thought, at first, they don't have an actual "definite need" to get their ERC sooner, and it can just be a "cool" thing to skip the waiting times on money that belongs to them.

Well, they were actually wrong.

While almost all of them didn't have a 'definite need' to get their ERC soon such as no money to pay for employees, no money for operations, or even worse, bankruptcy, etc.

They were still losing money every day that their ERC was delayed, unaware of it.

Probably 95% of those clients who kept waiting for their ERC could make more money if they have gotten it sooner and put it to work for their business.

For example, getting their ERC sooner could have given them the opportunity to expand their business, purchase more inventory, do more marketing, hire more employees, etc.

This means that every single day those businesses weren’t using that money and putting it to work, it's a day with a loss in potential additional sales.

So, before I get straight to the solution, ask yourself: How much money are you currently losing by NOT putting this money to work? How much money are you actually losing, only from waiting for your ERC to arrive? And that what brings me to:

Faster, cheaper capital = Business growth

If you've filed for the ERC, it means that you had at least 5 to 10 W2s in 2020 or 2021.

Also, it means that your business existed before 2020.

Taking those 2 facts into consideration, we can assume that in most cases, you have a pretty solid business, solid enough to immediately qualify for unsecured financing, and no, not the type where you pay 50% interest rate.

Unsecured financing instead of an ERC advance? What?

Yes, you heard me right, almost EVERY business that initially came to us for an ERC advance or a buyout ended up taking a Line of credit, equipment financing, term loan, SBA, working capital, or any type of our 10+ unsecured financing solutions.

Comparing it to an ERC advance, not only there is no personal guarantee and the process takes less than 48 hours, you also don't need to take off a HUGE amount like you used to with ERC advance and pay 20% over it.

Let's say your ERC claim is about $250,000, you probably need to pay around 20% for the ERC firm that handled your filing, which already brings your total claim to $200,000.

Why would you want to pay another 20% to 30%, taking your claim down to around $150,000, while you also have a personal guarantee over it! That doesn’t make sense.

Especially not when you can probably qualify for unsecured financing, pay much less, and get only the amount you actually need. Let's say you can use this money for marketing, do you really need $150,000 to $200,000 for that? Usually no, but even if so, you can get it for much cheaper without any guarantees and in no time.

Ok, but why would I take that instead of a traditional loan?

That's probably my favorite question clients ask me, and yes, a traditional loan is always cheaper compared to an unsecured loan (a lot of times not by far though).

Assuming you go for a traditional loan, not only will you need a very high credit score, but you'll also have a fixed interest rate and a guarantee over it, and you'll need collateral, and, not to mention you will go through one of the most longest, most frustrating processes of all times taking you at least a 30 to 60 days to secure the capital you need.

On the other hand, you can get a Line of credit or a working capital, where:

• Get the capital to your bank in less than 48 hours

• No effects on credit

• Easy qualification

• Simple, online process

• No fixed interest

• No time limit on repayment

I can keep going on, but what I want you to understand is that at the end of the day, yes, you might end up paying 2 times more for unsecured financing, but how much it is actually going to cost you to keep and keep waiting?

The recap - It's all about the ROI

Let's finish off with an example.

Let's assume that $100K can get you more inventory, or you can put it on things like payroll, marketing, etc.

Seeing how your previous inventory purchases or marketing campaigns have generated $300K in the past, you know it’s worth it to do this move, and you know that you can’t reach that point unless you’re able to get capital.

In your case, you don't want to get into debt, and you know that you need to get your ERC this year.

However, you do the calculation, and you see that waiting around simply costs you more money than taking action.

Yes, for borrowing $100K, you will pay at least $20K or $30K (depending on different factors),

BUT:

You just received financing under 48 hours.

You grow your business instead of just waiting around.

The repayment is relative to your sales, meaning if things go slower the payment is lower.

You don't have a time limit on the repayment or effects on credit.

And to top it all off, you didn't give any guarantee, not personal and no collateral.

So, while you paid $20K or $30K over the $100K you just took, it’s more than worth it because you just did a 300% ROI. Not only that, you also didn't lose another 20% of your ERC claiming amount, and, you can have a free mind not worrying about how long it's going to take for your check to arrive from the IRS.

Long story short, while taking an "ERC advance” usually doesn't make any sense, most of the businesses who look for that can actually get much more value with alternative financing.

Don't wait for your ERC check to arrive because it can take a while (I've already seen 1.5 and 2 years). Make sure to check all the solutions you can qualify for before taking an advance, which is probably the last option you should go for.

Oh and another golden tip - when looking for a lender, make sure they offer a variety of different solutions (Line of credit / SBA / term loan/ equipment, etc). That way, (assuming they are trustworthy) they will present you all the solutions you can qualify for, and who knows, maybe you'll end up paying the same rate as a loan from the bank, while taking advantage of all the other benefits unsecured financing offers.

So just keep that in mind.

Hope it helps.

-Ben

benjamin@savingsnyc.com

*DISCLAIMER: New York Savings serves as a trusted guide on your journey towards business financing.

Our platform is designed to offer invaluable insights, expert advice, and connects you with a range of potential lending options tailored to your unique business needs.

However, while we strive to provide accurate and up-to-date information, we cannot guarantee the completeness or accuracy of this information due to the dynamic nature of the financial industry.

Therefore, we strongly encourage all our users to conduct their own due diligence and seek independent financial or legal advice before making any financial decisions or commitments. By using our website and our services, you agree to our terms of service and acknowledge that any decisions based on information found on our site are your own responsibility.

Your engagement with New York Savings signifies your understanding and acceptance of these terms.

© New York Savings LLC. 2024